Widow’s MIL Pays for Funeral, Furious After Discovering Son’s Life Insurance Payout

Longer video/photograph feed and allow to continue reading Please give an overall site rating: 5/5 Generate your own review: 5/5 When a grieving widow (40s) discovers she is embroiled in a bitter dispute with her late husband’s mother over life insurance cash after the shock death of her husband – her husband (40s) – is 5/5 Arrive your own review: 5/5 When a grieving widow (40s) learns to her chaos she is locked in a vicious battle with her late husband’s mother over his life insurance money after the surprise death of her husband (40s) Image credit: Getty Images Plus As your turn - PLEASE RATE THIS ARTICLE WITH THE RATING OF 5 / 5 RATING. When the husband died, the widow (whose husband was the writer here) returned to her mother-in-law (MIL), who immediately insisted on paying for the funeral expenses, which the widow accepted gratefully in an emotional state. Many months later she recalled that, in her job, she had a life insurance policy in the name of her husband, and demanded a payout.

MIL then found out about the money from life insurance and started demanding that the widow pay her back for the funeral, calling the widow selfish for wanting and taking money from her dead husband. The widow, on the other hand, views the money as vital for her recovery and her future, as she hopes to use it to get her life back by starting up in a place closer to family. She understands that her MIL is hurt, but feels like the accusations came out of nowhere and questions whether not giving the money actually makes her the villain.

The author of the post recently lost her husband to whom she had been married for six years

It was a severe blow for the woman, and she was incredibly thankful to her MIL for volunteering to cover all the funeral expenses

Navigating Grief, Financial Obligations, and Ethical Dilemmas

The Financial Reality of Funeral Costs

The World over, funerals are expensive where the average funeral in the U.S. costs $7000-$12,000 (National Funeral Directors Association). Here, the offer of the MIL is somewhat both generous and pragmatic—since she clearly does not want to face this immediate financial burden. Nonetheless, such expenses tend to be the cause of friction when the financial roles and expectations are not clearly defined before-hand. In that regard, the widow was unaware of the life insurance policy at the time, and so didn’t expect this feud to arise.

Legal Context of Life Insurance Payouts

From a legal perspective, the proceeds from a life insurance policy return only to the beneficiary named on a policy. The proceeds are designed to support the beneficiary financially, often paying necessary living expenses, debts, or other future plans after the death of the policyholder. Here, the widow has no legal requirements to use that money to pay for the funeral unless she agreed to reimburse them in advance. Investopedia mentioned that unless there is a contractual obligation, beneficiaries are entitled to put their own financial needs first.

Ethical and Emotional Considerations

Yes, the widow is right to collect the payout, but that entangle with the ethical issue, where the needs of her MIL should match her own grievance and financial obligation. In other words, the accusations of the MIL are most likely a result of her feeling a very much raw, fresh, and harsh pain and frustration that she is not managing to go through her son’s death and everything that entails it on an emotional — and financial — level. Resentment and entitlement come into the picture thanks to grief (and money).

Emotionally, the widow also copes with the loss of her husband as well as major shifts in her everyday life. Rebuilding her life — moving, getting a place to stay — in that context is exactly what a life insurance policy is for. But it might ease some of the tension if she offered to pay her MIL back, just a little, for service provided.

How to Resolve the Conflict

- Open Communication: The widow could initiate a calm, heartfelt conversation with her MIL, explaining her financial situation and how the insurance money is critical to her future stability.

- Compromise: While she’s not obligated to reimburse the full funeral costs, offering a partial repayment could demonstrate empathy and soften the conflict.

- Seek Mediation: In cases where emotions run high, involving a neutral third party (e.g., a family mediator or counselor) might help facilitate constructive dialogue.

Case Studies of Similar Conflicts

It is not unusual to have disputes over life insurance or the distribution of an estate. As an illustration, a paper in the Journal of Financial Therapy identified that ambiguous communication and implicit expectations are the major contributors to family conflicts post mortem regarding planning disposition of financial assets. Specific agreements—whether general or written—can circumvent this clash, which underscores that even in times of emotional upheaval—particularly times of emotional upheaval—it is still necessary for former partners to discuss who is responsible for what finances.

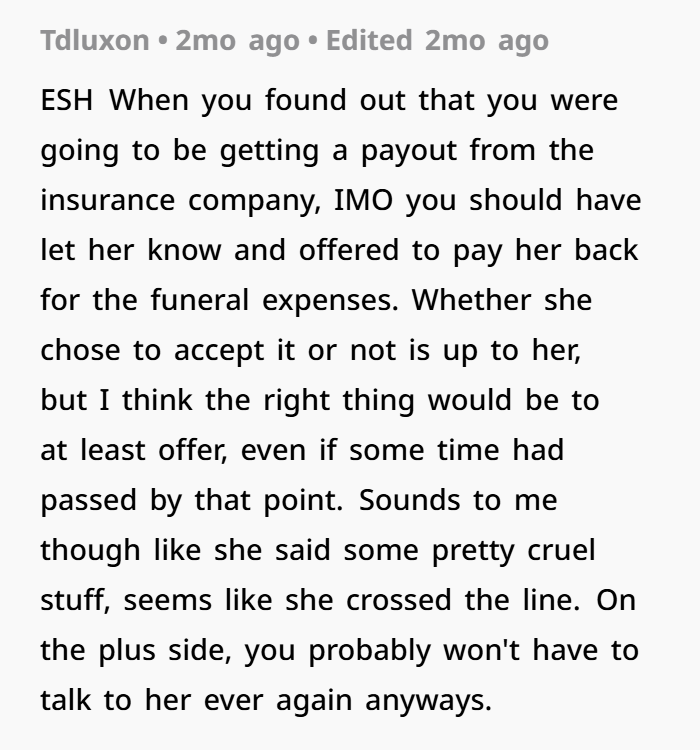

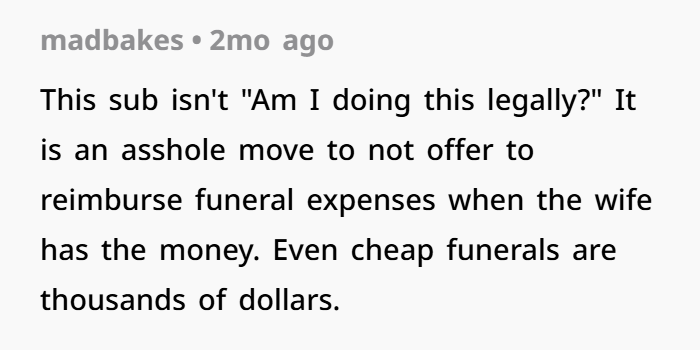

People in the comments were very divided, but most of them urged the author to pay the MIL back at least part of her expenses

The widow is not the asshole because she his looking after her own interests in an unimaginably challenging situation, and the life insurance is hers as a matter of law. Even if she is not required to pay back the funeral money, giving a small amount back may help in repairing her relationship with her MIL. Ultimately, both are reeling from devastating loss, and perhaps the art of empathetic dialogue will lead to a shared understanding of each other.