My Ex Tried to Budget My Son’s Survivor Benefits—Now I’m Choosing Peace Over Control

This story revolves around a mother (38F) trying to protect her 15-year-old son’s survivor benefits from what turned out to be a controlling and manipulative fiancé. OP’s son receives $1,100 per month from Social Security after the death of his father. Half of that goes directly to her son for personal spending; the rest is saved for his future. But when her boyfriend (40M)—with whom she shares a long, rocky history—proposed and began planning their shared life, things took a dark financial turn.

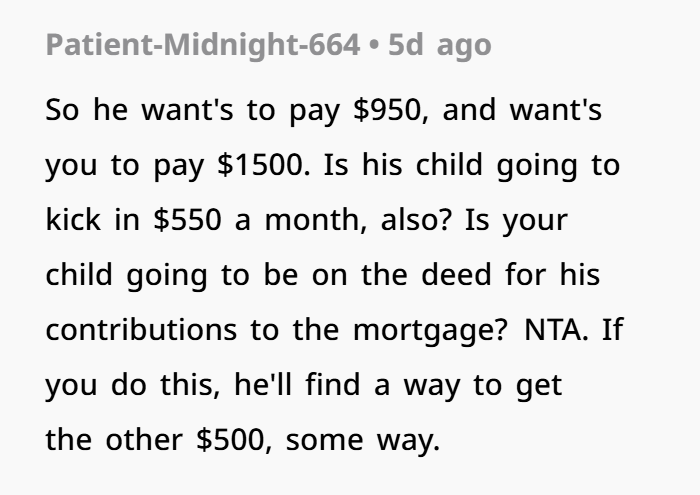

They discussed moving in together, blending their families, and splitting expenses. That’s when her fiancé suggested a household budget where $600 of her son’s benefits would go toward paying the mortgage—while reducing both adults’ contributions to $950 each. He framed it as “shared family budgeting,” but OP immediately felt uncomfortable. The money was meant for her son’s care, not to subsidize her fiancé’s share of the rent.

The backlash was swift, but more red flags popped up: her fiancé wasn’t paying child support for his child, he became verbally abusive during arguments, and even threatened to cause scenes at her family’s homes. What started as a financial dispute turned into a wake-up call. The relationship ended, and OP took steps to block contact, protect her peace, and center her child’s well-being.

Some people are so shameless, they don’t even hesitate to mooch off money from kids

The poster’s boyfriend popped the question, and they plan to get a house together, which costs $2,500 per month

Okay, let’s talk about the deeper stuff here. Because this story isn’t just about budgeting—it’s about financial boundaries, parenting rights, and what happens when control hides under the mask of “family planning.”

💸 What Are Social Security Survivor Benefits Actually For?

Let’s start with the basics: Social Security survivor benefits are intended for the care and support of a deceased worker’s child. Not for rent. Not for groceries. And definitely not for covering a new partner’s living expenses.

According to the Social Security Administration (SSA):

“Monthly survivor benefits for children are designed to help with the child’s basic needs—like food, clothing, education, and shelter—until they become adults.”

But that doesn’t mean it’s fair game for household bills in a blended family setting.

What OP was doing—giving her son a portion for personal use, saving the rest—is not just thoughtful parenting, it’s responsible money management. Many parents use survivor benefits to teach financial literacy, saving habits, and independence. And by law, the child’s primary caregiver (in this case, OP) must manage the funds in the child’s best interest.

Let’s be clear: using survivor benefits to lessen an adult’s financial burden is not the child’s responsibility.

🚨 Why the Boyfriend’s Budgeting Plan Was a Huge Red Flag

On the surface, his proposal might look “reasonable.” After all, they’re combining households, right?

Wrong. Here’s why:

- He immediately viewed the child’s benefits as family income

That’s financial overreach. He’s not the child’s guardian, and he doesn’t contribute to the benefit. - He wanted to reduce his own share of the rent

He wasn’t proposing a fair split. He wanted to shift responsibility from himself to a 15-year-old. - He’s not even paying child support for his own child

This one speaks volumes. If he’s not supporting his own kid, why is he comfortable using another child’s benefits? - He pressured OP into giving up financial control

That’s financial manipulation. And it’s a classic early warning sign of financial abuse—a tactic often used to control or isolate a partner.

🛑 Let’s Talk About Financial Abuse (Because That’s What This Is)

Financial abuse doesn’t always start with controlling your bank account. Sometimes, it starts small: a shared budget. A passive-aggressive comment about “pooling resources.” A suggestion that your money should be used for his expenses.

According to the National Network to End Domestic Violence (NNEDV):

“Financial abuse is a common tactic used by abusers to gain power and control in a relationship.”

And it can look like:

- Limiting access to money

- Forcing you to contribute more than your share

- Guilt-tripping or manipulating you about family finances

In OP’s case, her ex tried to disguise control as “blended family budgeting.” But it became clear—he wasn’t interested in fairness. He was interested in managing her son’s money to benefit himself.

🧾 The Ethics of Using a Child’s Benefits in Household Budgets

Let’s be real—sometimes, families do use survivor benefits for rent or bills. Especially when the child lives in that household. That’s not inherently wrong, if the funds are truly used for the child’s needs.

But here’s the key: it should never be a way to let adults off the hook financially.

In blended families, it’s even trickier. Using one child’s benefits to support a household that includes unrelated siblings and a partner who contributes less? That creates inequality—and resentment.

OP’s instincts were spot on. Her son’s money wasn’t for her ex’s rent discount. It was for the boy’s care, comfort, and future.

🔥 What This Story Really Shows: Control vs. Partnership

This wasn’t about rent. It was about control.

- Control over OP’s finances

- Control over her parenting decisions

- Control over how their household would function

And when she pushed back? He lashed out. Verbally. Emotionally. Then made threats that scared her enough to document everything.

That’s not a partner. That’s a person showing you exactly who they are when they don’t get their way.

💪 The Power of Choosing Peace (and a Strong Exit)

Here’s where OP shines: she didn’t wait for it to get worse. She ended things when the mask slipped. She put her son first. She blocked contact, involved others for safety, and prepared to document threats.

That’s not “dramatic.” That’s protective and smart.

It’s also a reminder to all of us: when someone shows you they’re willing to manipulate, gaslight, and disrespect your kids’ rights for their own comfort?

Believe them. And run.

Folks were horrified by how the man blatantly tried to manipulate her, and some even claimed he proposed just for the money

No, OP, you weren’t being selfish. You were protecting your son’s financial future—and your peace of mind. Your ex’s behavior wasn’t about “family budgeting.” It was about control. And now, you’re free.

If you’re in a similar situation, here’s the rule: If someone wants control over your child’s benefits before they even commit to supporting them? That’s not a future—that’s a red flag.