As we speak, every little thing from a film ticket to varsity tuition is costlier than it was a number of a long time in the past. And wages should not rising as quick as costs.

Freddie Smith, a realtor from Orlando, Florida, mentioned this can be a uncommon sight within the housing sector.

Earlier this month, Smith launched a TikTok videothe place he breaks down the maths behind why Millennials are having a tougher time shopping for a house than Child Boomers.

The numbers look fairly grim, and the worst half is that you would be able to’t actually argue with them.

Extra info: Instagram | TikTok

Photograph credit: fmsmith319

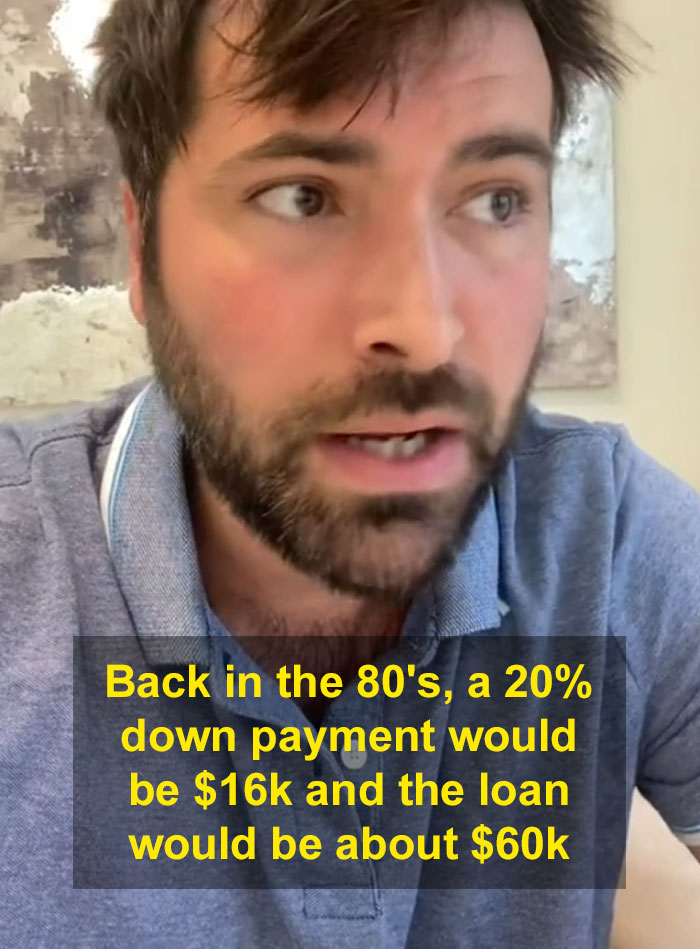

“Any time a millennial tries to elucidate this to a boomer, they at all times use the identical instance. They are saying, ‘effectively, my rate of interest is 15%, you’ve got six and a half, you are very fortunate.’ Properly, let us take a look at it this manner.”

Photograph credit: fmsmith319

“In case you purchased a home for $80,000, within the ’80s, a 20% down cost could be 16 grand, and the common individual was making about $30,000 again then. So your down cost is just half of your annual wage.”

“And the mortgage you will get right here is about $60,000. So to repay the $60,000, if you happen to actually need to, you solely have two years of wage left, and you’ll repay your own home.”

Photograph credit: fmsmith319

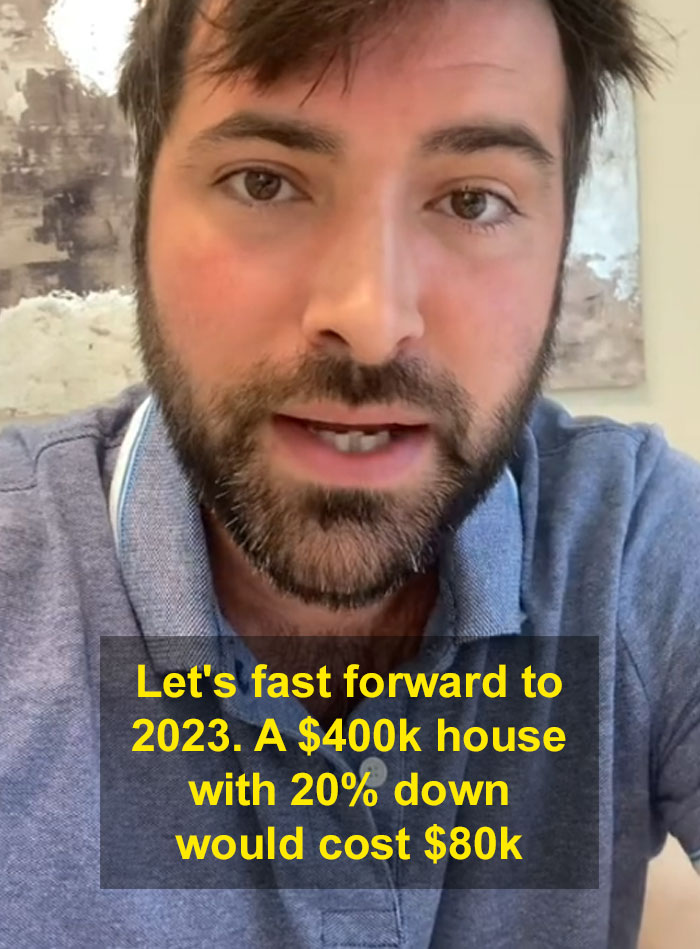

“Properly, let’s quick ahead to 2023 and I dwell in Orlando, so I am going to use this for instance. A $400,000 dwelling with 20% down is value $80,000. Identical to a down cost. The common individual makes $50,000.”

“So it is virtually twice their annual wage only for the down cost, then they’ve an excellent $320,000 mortgage they’ve to have a look at.”

Photograph credit: fmsmith319

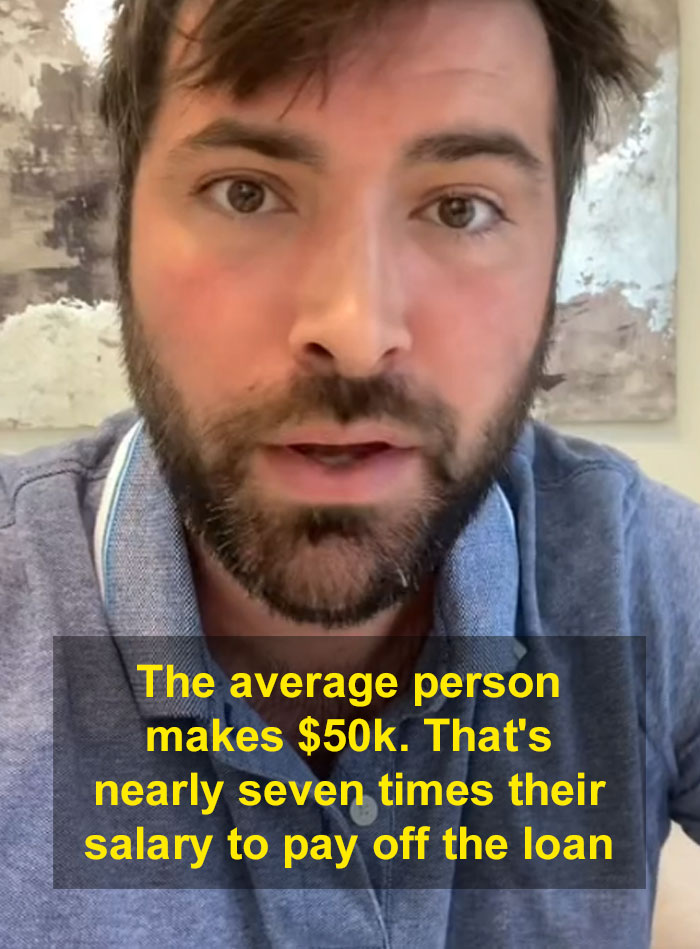

“That is about seven instances their wage to repay the mortgage, no matter, and then you definately go ‘effectively, 15%, we’ve got a better payment.’ All of the individuals shopping for homes now, I am an actual property agent right here, so I see it on a regular basis.

“It is extremely uncommon that individuals put 20% down, individuals put three to five% down, the place a 6% rate of interest remains to be taking pictures the mortgage by means of the roof. Individuals’s funds on these homes are $3,300, $3,500 a month, on a mean, easy, three-bed, two-bath home. So that is the distinction.”

Photograph credit: fmsmith319

“Millennials are complaining and folks cannot get a mortgage. I do not know the reply to that. However I am on this stuff on daily basis and most of our purchasers, I child you not, are of their 50s, 60s and 70s.

“It is very uncommon for us to see a millennial or particularly anybody youthful, apart from a pair the opposite day, and the agent pulled me apart and mentioned ‘hey, they should ship this video to their dad and mom as a result of they’re paying for it.’ Good for them. That is wonderful. However that is the scenario with millennials.”

@fmsmith319 Responding to @JosiahFuerte ♬ original sound – Freddie Smith

Photograph credit: fmsmith319

Millennials, which embody individuals born from 1981 to 1996, have it powerful. After they had been adults, the oldest within the group confronted the housing disaster and the Nice Recession of the late ’00s, whereas the youngest graduated school till the pandemic.

With their lives suffering from pupil debt and financial uncertainty, it is no surprise most of them lease.

Nevertheless, based on a research by RentCafeby 2022, Millennial home-owner households will change into the generational majority, at 51.5 %.

Previously 5 years, about seven million Millennials have joined the ranks, bringing the full to about 18 million, and even thought to have greater than tripled the good points of Gen X (born 1965 to 1980), including 2 million new home-owning households, for a complete of about 24 million, Millennials nonetheless personal fewer properties than the older technology.

Child boomers (born 1946 to 1964), nonetheless personal essentially the most properties, about 32 million, however misplaced about 350,000 owners over the identical time interval.

Smith’s video actually resonated with individuals, and impressed many to share their private tales